BB&T Auto Loan Rates and Calculator

How to Apply for Auto Loan With BB&T

All applicants must apply at a branch location. BB&T offers its clients a free service of financial calculators to help in their decision of how much to borrow, for what term, and if they should refinance.

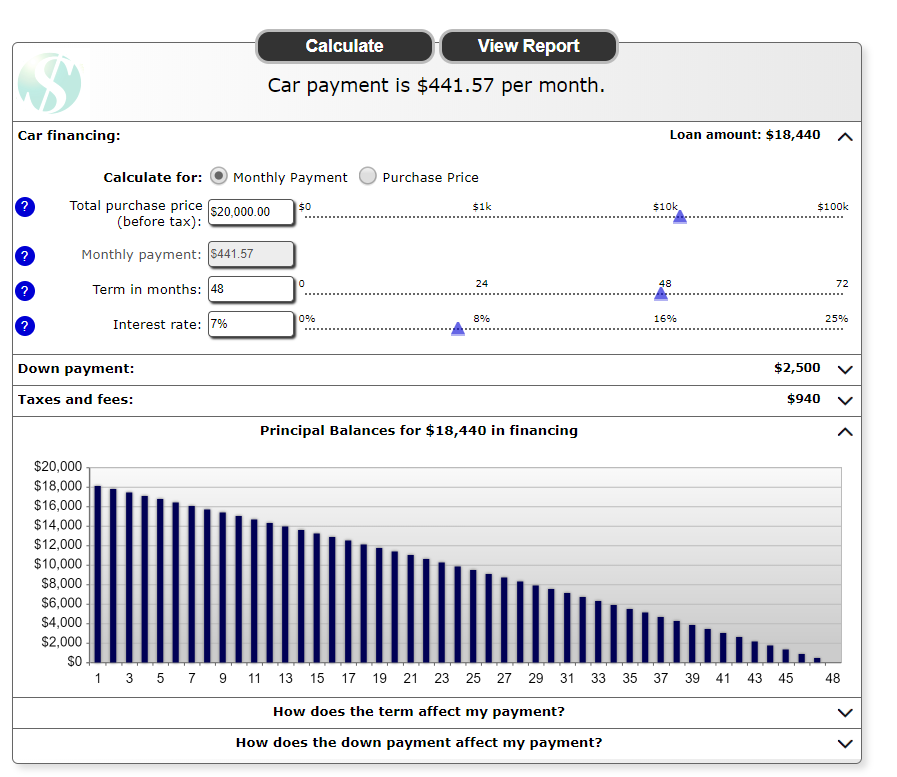

Calculators For BB&T auto loans

You can use this calculator to both find out the monthly payment as the final purchase price. You have to choose between these two options and then fill in with information as:

• Total purchase price

• Monthly payment

• Loan Terms (months)

• Interest Rate

Click on Calculate and see the results. You’ll also have a graph helping you to analyze the numbers.

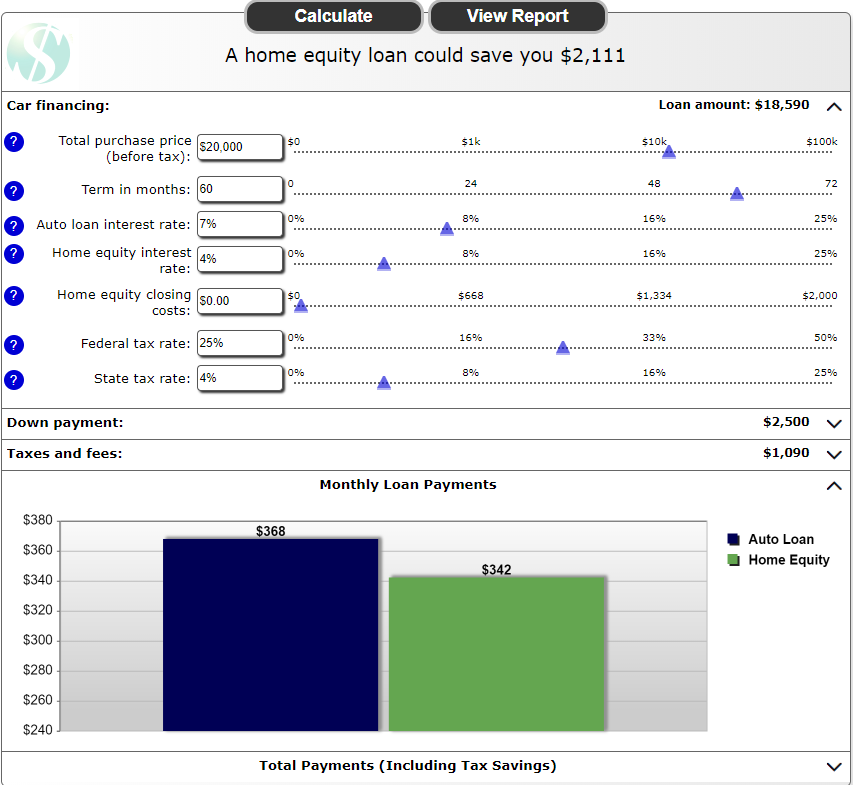

Should I Use a Home Equity Loan Instead of an Auto Loan?

Some people choose to use the home equity loan since the interest rates are lower and can be deducted. If you find yourself in the same situation, this calculator will show you if this change is the best option. https://www.bbt.com/iwov-resources/calculators/AutoEquityLoan.html?height=550&width=650

Fill in with the required information as :

1 – Car Financing

- 0% introductory APR for 15 months on purchases and balance transfers

- Variable APRs ranging from 13.24% to 22.24% afterwards

- No annual fee

2 – Down Payment

- Cash Down

- Trade allowance

- Amount owed on trade

3 – Taxes and Fees

- Fees

- Sales tax rate

Click on Calculate and see the results.

Which is Better: a Rebate or Special Dealer Financing?

If you have doubts as whether you should take advantage of low interest financing or a manufacturer rebate, use this calculator to help you to do the best decision.

Auto Rebate vs. Low-Interest Financing Calculator

Fill in with the required information as:

- Total price

- Loan term (months)

- Sales tax rate

- Low interest financing

- Traditional financing

- Manufacturer debate

- Cash down

- Trade allowance

- Amount owed on trade

Click on Calculate and compare the results.

Does a Home Equity Loan Make Sense for my Next Automobile Purchase?

Home Equity Loan vs. Auto loan Calculator

Fill in with the required information as :

1 – Car Financing

- Purchase price

- Loan term (months)

- Auto loan interest rate

- Home equity loan interest rate

- Home equity closing costs

- Federal and state tax rates

2 – Down Payment

- Cash down

- Trade allowance

- Amount owed on trade

3 – Taxes and Fees

- Fees

- Sales tax rate

Click on ‘Calculate’ to see the results.

How Much Can I Spend To Buy A New Automobile?

This calculator is for those who want to know how much they can spend to buy a new automobile.

To find out which vehicle you can afford, just fill in with the required information as:

1 – Car Financing

- Purchase price (before tax)

- Loan term (months)

- Interest rate

2 – Down Payment

- Cash down

- Trade allowance

- Amount owed on trade

3 – Taxes and Fees

- Fees

- Sales tax rate

Click on ‘Calculate’ to see the results.